Zoho: The Indian SaaS Giant, Ministerial Support & its Role in India’s Self-Reliant Tech Drive

Zoho, the Chennai-based SaaS giant, is trending after India’s IT Minister switched to its office suite, reinforcing the Swadeshi tech push. Learn what Zoho does, its financials, how it stacks up against Microsoft & Google, and what its growing adoption means for India’s tech self-reliance.

What is Zoho? Company Background & Products

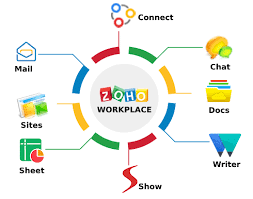

Zoho Corporation is an Indian multinational tech company founded in 1996 by Sridhar Vembu and Tony Thomas. Originally called AdventNet, Inc., it rebranded to Zoho in 2009. The company builds a large suite of software products (cloud-based, SaaS) for business users, including office productivity tools, CRM, finance, human resources, collaboration, analytics, and more.

Some key facts:

- Headquarters in Chennai, India; also has a corporate presence in Austin, Texas.

- Privately held; has never raised external venture capital—Zoho is bootstrapped.

- More than 100 million users worldwide across its many apps.

- Revenue in FY23 approx ₹8,703 crore, with net income / profit over ₹2,800 crore.

Zoho’s product portfolio includes Zoho CRM, Zoho Books, Zoho Mail, Zoho Office Suite, Zoho Creator, Zoho One (which bundles many apps), Zoho Desk, Zoho Cliq, Zoho Analytics, etc.

Zoho’s Recent Move: Why It’s Trending Today

Zoho is trending in Indian news today (as of 22-23 September 2025) largely due to the following:

- Swadeshi / Self-Reliant India Push

India’s Union Minister for Electronics & IT, Ashwini Vaishnaw, has announced that he is switching to Zoho’s office suite (documents, spreadsheets, presentations). This aligns with the government’s call to adopt indigenous (Swadeshi) technologies. - Public Endorsement & Symbolism

The move by a senior minister gives strong symbolic weight to the idea of using Indian software in place of foreign alternatives. This kind of endorsement tends to generate media attention and may encourage private entities to consider switching too. - Zoho’s Rising Growth in India

Zoho has been already seeing strong growth domestically; India has become one of its fastest-growing markets, with large customer growth, new product launches (like Vikra for seller app on ONDC, IoT tools etc.) - Visa / Global Tech Talent Context

Separately, Zoho founder Sridhar Vembu has been making statements urging Indian tech professionals working abroad (particularly under H-1B visas) to return, in light of recent visa fee increases. This ties into both talent retention and the Swadeshi/self-reliant narrative.

So the combination of political backing, cultural / national tech self-confidence, visible product maturity, and growing domestic footprint is why Zoho is trending now.

Zoho’s Strengths & Financials

Financials / Scale

- Revenue ~ ₹8,703 crore in FY23.

- Profit after tax crossing ~ ₹2,800 crore in FY23.

- User base over 100 million across more than 50+ applications and in over 150 countries.

- In India, Zoho saw customer growth of ~31-37% in recent period; new launches aimed at local needs (ONDC seller app, IoT platform).

Strengths

- Bootstrapped and profitable: no dependency on external VC funding reduces external pressure.

- Wide product suite: can serve many business needs under a unified ecosystem (CRM, office suite, mail, finance etc.).

- Cost advantage vs big global SaaS companies (often lower prices, localized support).

- Local presence, including rural offices, attention to Indian needs (language support, local regulations etc.).

Peer Comparison

Here’s a comparison of Zoho with some of its global / Indian peers in SaaS / cloud business software:

| Feature | Zoho | Microsoft 365 / Office | Google Workspace | Salesforce |

|---|---|---|---|---|

| Ownership | Privately held, bootstrapped | Public company (Microsoft) | Public (Alphabet / Google) | Public company |

| Product suite breadth | Very broad—all-in-one SaaS solutions (CRM, office, finance, HR etc.) | Strong in office productivity, collaboration, enterprise tools | Strong in collaboration, email, cloud storage | Strong in CRM and sales / enterprise customer management |

| Pricing / Cost | Generally lower for SMBs; local pricing advantage in many markets | Higher, especially for enterprise | Moderate, but often global pricing with add-ons etc. | Premium pricing, often for enterprise segment |

| Localisation & Indian / Swadeshi push | Strong focus on India; recent political backing; local product/feature adjustments | Broad global presence; Indian localisation but less tied to national policy | Similar to Microsoft; strong user base | More focused on enterprise sales; less on office suite / full stack business operations for SMBs |

| Profitability / Sustainability | Profitable; no external funding pressure | Very profitable; diversified revenue | Very profitable; huge scale | Profitable, but high R&D and acquisition costs |

| Ideal segment | SMEs, businesses wanting integrated stack; businesses wanting alternative to big global suites | Enterprises, large orgs, education + corporate usage | Individuals, education, collaboration focused teams | Sales / customer-oriented companies needing advanced CRM, customer service etc. |

India’s Swadeshi Tech Adoption & Zoho’s Role

The “Swadeshi tech” idea (using indigenous or locally developed tech tools) has been gaining traction in India. Key aspects where Zoho is playing a role:

- Government push: Policies encouraging use of Indian software, digital sovereignty, data localisation. When ministers or government bodies start using tools like Zoho, it sends a strong signal.

- Public awareness: Citizens, startups, small businesses are more conscious about dependency on foreign tools, especially amid geopolitical tensions, privacy concerns etc.

- Localised solutions: Zoho’s products often support Indian languages, regulatory compliance (GST, local tax laws etc.), and local payment / integration systems which foreign tools may not cover as neatly.

- Talent return & build local ecosystems: When tech leaders encourage diaspora to return and invest locally, companies like Zoho benefit. Also, Zoho’s rural investment (offices outside big metros etc.) helps distribute tech growth.

Challenges & What to Watch

- Competing with giant global SaaS players with massive budgets (Microsoft, Google, Salesforce) is always tough, especially in enterprise/large customer segments.

- Feature parity: Some users feel Zoho’s tools are good but may lag in certain advanced capabilities, integrations, or polish vs premium counterparts.

- Scaling margins while also localising/supporting many markets is costly.

- Privacy/data security expectations are high; any lapses could hurt reputation.

- Strategic bets (like the earlier plan for chip manufacturing) have had setbacks. For example, Zoho’s planned $700 million semiconductor project was suspended for lack of suitable technology partner.

Conclusion

Zoho is more than just a SaaS company; it’s become a symbol of India’s growing capability in producing global-scale technology, especially under the Swadeshi/self-reliance narrative. Its recent endorsement by government leaders for using domestic tools adds momentum to that image.

If you’re a small or medium business, or startup, Zoho offers considerable value: an integrated ecosystem, lower cost, local support, and alignment with national policy pushes. For larger enterprises, it may be one of several tools in the stack, especially when considering cost vs features.

Today, Zoho’s trending because of the convergence of political will, self-reliance discourse, and its own steady growth & maturity. Its journey is a case study in how a bootstrapped, privately-held tech company can scale globally without losing its roots — a template many in India hope to follow.