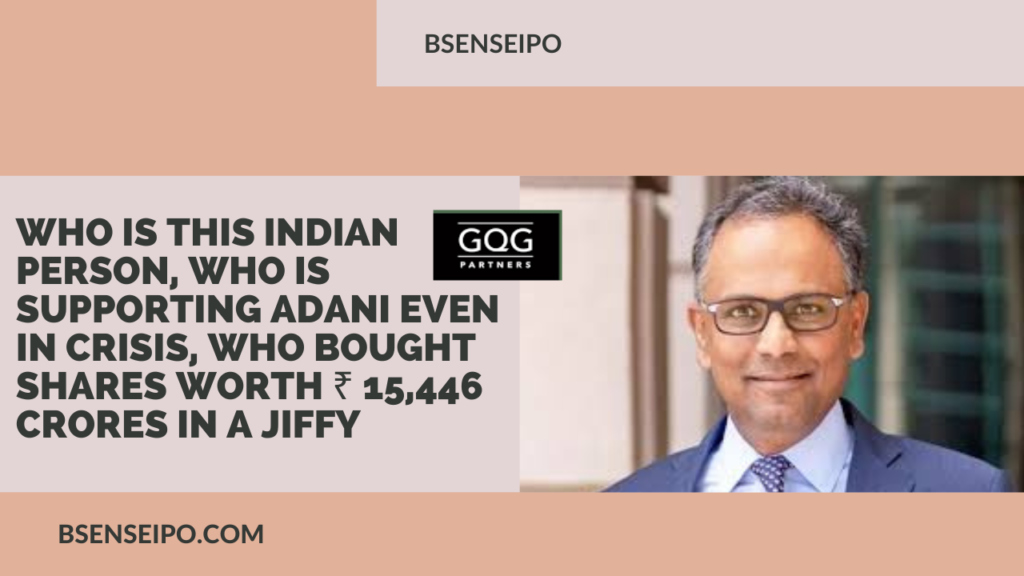

Who is this Indian person, who is supporting Adani even in crisis, who bought shares worth ₹ 15,446 crores in a jiffy

GQG’s Rajeev Jain kept an eye on Adani shares for 5 years, waiting for the right price to invest

American boutique investment firm GQG Partners has invested Rs 15,446 crore in four Adani group companies. The owner of this American company is Rajeev Jain. Jain is the chairman and CEO of US-based Australia-listed GQG Partners. Rajeev Jain’s company has bought substantial shares of Adani Ports and Special Economic Zone, Adani Green Energy, Adani Enterprises Limited, and Adani Transmission.

Rajeev Jain, Chairman, and Chief Investment Officer, of GQG Partners, said, “We believe these companies have substantial long-term growth prospects”. We are very pleased to invest in these companies, which will help advance India’s economy and energy infrastructure. He further adds, “Adani companies own and operate some of the largest and most important infrastructure assets across India and around the world. Gautam Adani is widely considered to be among the best entrepreneurs of his generation. We believe that these companies have substantial long-term prospects and we are happy to invest in those companies. Let us inform you that the GQG investment comes at a time when Adani Group is surrounded by crisis after the Hindenburg controversy. The market value of seven listed Adani companies has lost about $135 billion since January 24.

GQG Partners has bought this stake through multiple block deals on the stock exchange. The 4 companies in which this stake has been bought include Adani Enterprises, Adani Ports, Adani Transmission, and Adani Green.

How much stake in which company did you buy?

GQG Partners has bought this stake through multiple block deals on the stock exchange. The 4 companies in which this stake has been bought include Adani Enterprises, Adani Ports, Adani Transmission, and Adani Green.

GQG has bought a 3.4% stake in Adani Enterprises for about Rs 5,460 crore.

Bought a 4.1% stake in Adani Ports for Rs 5,282 crore. 2.5% stake in Adani Transmission for Rs 1,898 crore and 3.5% stake in Adani Green Energy for Rs 2,806 crore.

Who is Rajeev Jain?

Rajiv Jain was born in India. He moved to the US in 1990 to pursue an MBA at the University of Miami.

He joined Vontobel in 1994, being made CIO of the Swiss firm in 2002.

CNBC TV18 reported on Thursday that Rajeev Jain’s Indian holdings include ITC, HDFC, RIL, ICICI Bank, SBI, Sun Pharma, Infosys, and Bharti Airtel. Jain does not have a Twitter account and rarely appears on TV. They typically invest in 40 to 50 large-cap stocks in their international funds, compared to the benchmark’s 2,000-plus companies. His US fund holds fewer than 30 stocks, compared to over 500 in the S&P index.

What did Jain say on the Hindenburg Report?

Rajeev Jain said in the Hindenburg Report, “They have their point of view and we have ours. We disagree with their point of view, and that is what makes the market.” He said, “Many governments have come and gone in the meanwhile. A fraud usually does not last for 30 years. It can be a maximum of 3 months or 3 years, but not 30 years.”

MORE FOR YOU