Global Semiconductor Market to Cross $1 Trillion by 2030, Driven by AI and 5G Demand

The semiconductor market industry, valued at $627 billion in 2024, is projected to reach $1,030 billion by 2030, powered by AI, EVs, and next-gen connectivity.

The global semiconductor market is on track for exponential growth, projected to rise from $627 billion in 2024 to $1.03 trillion by 2030. Analysts attribute this surge to transformative technologies such as artificial intelligence (AI), electric vehicles (EVs), 5G, and next-generation computing that are intensifying chip demand across industries.

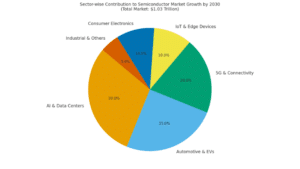

AI, Cloud, and Data Centers Drive Demand

Generative AI, large language models, and cloud computing are fueling unprecedented demand for high-performance chips. Companies like Nvidia, AMD, and Intel are scaling up production of GPUs and AI accelerators, while hyperscalers including Amazon, Google, and Microsoft continue investing in custom silicon.

Automotive and EV Boom

Semiconductors are no longer limited to smartphones and PCs. The automotive sector is emerging as a key driver, with EVs and autonomous vehicles requiring advanced power electronics, sensors, and microcontrollers. Market research indicates that chips per car are set to more than double by 2030.

5G, IoT, and Connectivity

The rollout of 5G networks and expansion of the Internet of Things (IoT) will significantly boost demand for communication chips, modems, and sensors. With billions of connected devices expected by 2030, semiconductor companies are investing in edge computing and low-power solutions.

Regional Shifts and Supply Chain Strategy

Geopolitical tensions and supply chain disruptions have pushed countries to invest in domestic semiconductor manufacturing. The U.S. CHIPS Act, EU Chips Act, and India’s semiconductor mission are part of a global race to reduce dependency on East Asian fabs. This diversification is expected to create new regional growth hubs.

Challenges: Supply Chain and Capital Intensity

Despite growth prospects, the semiconductor industry faces risks:

- Capital intensity: Building fabs costs tens of billions of dollars.

- Supply chain fragility: Disruptions in raw materials or geopolitical flashpoints can slow production.

- Technological limits: Shrinking transistor sizes below 2nm poses engineering hurdles.

Sector-Wise Contribution Chart

Here’s the sector-wise contribution chart showing how AI, EVs, 5G, IoT, and other industries are expected to drive semiconductor market growth toward the $1.03 trillion mark by 2030.

Outlook

By 2030, the semiconductor industry will likely surpass the $1 trillion milestone, cementing its role as the backbone of the global digital economy. With AI, EVs, and 5G setting the pace, the next five years will be critical in shaping industry leaders, supply chain dynamics, and global tech competitiveness.